We’re J. Jervis Accounting Services.

Leave the numbers to us! Our expert team will handle all your tax and accounting requirements, allowing you to focus on growing your business.

Your Local Accounting Company in Wrexham, WLS, for Reliable Financial Support

At J. Jervis Accounting Services, we provide clear and straightforward accounting solutions. Our services include managing daily records, bookkeeping, tax return filing, and support for self-assessment tax returns. We establish organized systems, monitor cash flow, and offer strategic tax planning tailored to your goals. We ensure that every step is transparent and timely for both businesses and individuals in Wrexham, WLS.

Accountants for Business Accounting and Personal Tax

Get reliable assistance from local accountants who communicate clearly. Your dedicated tax accountant will manage tax preparation, bookkeeping, payroll, VAT returns, and year-end accounts. Our bookkeeper maintains organized ledgers, prepares monthly reports, and handles reconciliations. We offer personal tax services, including timing, allowances, reliefs, and practical stress-reduction advice. Our business accounting services ensure compliance, allowing you to focus on sales and service in Wrexham.

We make the complex simple

We offer full tax, booking and accounting services, so you can focus on everything else in your business.

With our expertise and know-how, we'll help you save money, reduce stress, and focus on you're real priorities.

Our Services

All-in-one Business Tools

Tax Returns

Plan ahead to minimize liabilities and file on time. We offer tax preparation for self-assessment and company returns, along with ongoing tax planning support.

Audit

Our independent audits assess records, controls, and compliance, providing a clear report with actionable findings to strengthen your business.

Accounting

As your local accountancy firm in Wrexham, we provide bookkeeping, business accounting, and management accounts reporting, ensuring your financial records are accurate and up to date.

Consulting

We offer practical advice on cash flow, systems, and growth, helping you navigate tax planning that is aligned with your goals and risk profile.

VAT Return

We prepare and submit quarterly VAT returns using MTD-ready software, efficiently handling HMRC queries and ensuring accuracy.

Tax Forensics

Our reviews identify errors or fraud in your financial records, providing detailed findings and step-by-step solutions to improve control.

Payroll Services

We manage payroll and bookkeeping on schedule, covering RTI and pensions. We also provide payslips, summaries, and organised year-end forms.

From the very first day of consultation, I have trusted Jervis with all of my accounting needs. They are professional, reliable, experienced, and so easy to work with.

Ayo Ogunrekun

Testimonials

We Are Trusted Over 16+ Industries

Having issues with HMRC recently, we decided to use a local accounting company, J. Jervis Accounting, which met our needs. Jason is very knowledgeable and friendly, and we would not hesitate to recommend him to our friends.

Emma, Wales

Start Building Financial Confidence Today

Whether you’re an individual, startup, or established business, our chartered accountants are ready to support your success. Contact J. Jervis Accounting Services today for professional accounting services in Wrexham and request your free consultation to get started.

Testimonials

We Are Trusted Over 16+ Countries Worldwide

I was so overwhelmed with my bookkeeping that I was falling behind on my taxes and other financial obligations.He was able to get my books in order quickly and efficiently.

JANE DOE

I am so grateful for [bookkeeper's name]'s bookkeeping services. She has taken all of the stress out of managing my finances and I can now focus on running my business.

JANE DOE

FAQ

What is the difference between bookkeeping and accounting?

Bookkeeping is the process of recording financial transactions and preparing financial reports. Accounting is a broader term that encompasses bookkeeping, as well as other tasks such as financial analysis, tax planning, and auditing.

What kind of businesses do you work with?

We work with a variety of small businesses, including restaurants, retail stores, professional services firms, and online businesses.

What are your qualifications and J Jervis Clients Experience?

All of our bookkeepers are qualified and experienced professionals. They have the necessary training and experience to provide accurate and reliable bookkeeping services.

Do I need an accountant for Self Assessment, and when is the Self Assessment deadline?

Yes, an accountant can help with self-assessment. You must file your tax return online by 31 January after the tax year. They ensure accurate submissions, maximize allowances, and help you avoid penalties.

How often must I submit VAT Returns, and what records should I keep?

Most VAT returns are submitted quarterly. You are required to maintain digital VAT records and submit your returns using compliant software. We ensure that records are accurate, reconcile VAT, and submit VAT returns on time.

Do all VAT-registered businesses need Making Tax Digital (MTD) for VAT software?

Yes, all VAT-registered businesses must comply with MTD for VAT. This means you must keep digital records and file your VAT returns using software. We offer MTD-ready systems, training, and ongoing support for VAT compliance.

How do payroll services and RTI submissions work for small businesses?

Payroll services assist small businesses by calculating employee pay and deductions and issuing payslips. Under Real Time Information (RTI) rules, employers must report payroll to HMRC on or before payday. We ensure accurate payroll management and submissions.

Get In Touch

Email: [email protected]

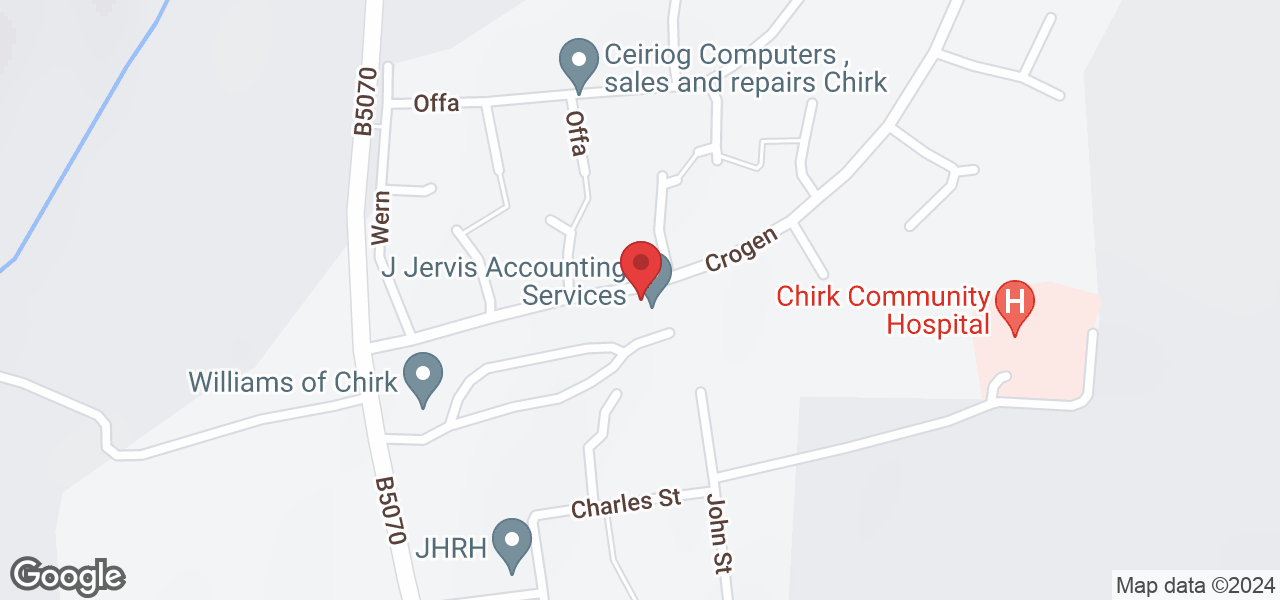

Address: 37 Crogen, Wrexham Denbighshire LL14 5BN

Hours :

Mon – Fri 9:00 am - 6:00 pm

Sat - Sun – CLOSED

Phone:

Office: 01978515568

Mobile: 07535066135